Sovereign Green Bonds for India’s Green Goals

Background

In the budget speech of 2022, India’s Finance Minister, Nirmala Sitharaman had announced issuance of sovereign green bonds (SGBs) to achieve the country\’s objective of carbon neutrality by 2070[1]. In October this year, the Finance Ministry approved the SGB framework which is designed to gather funds for supporting state-run projects which will reduce carbon emissions in the years to come.

Explained

What are sovereign green bonds (SGBs)?

Sovereign green bonds are issued by the Indian government to assist those organisations and projects which will focus on climate change mitigation, reduction in greenhouse gas emissions, climate adaptation, and reduce environmental risks. These are debt instruments and are a crucial part of ESG (environmental, social, and governance) investing[2].

In India, green bonds have been issued since 2015. During 2018 – 2022, $8 billion worth green bonds were issued which accounts for about 0.7 percent of bonds[3] issued in the financial market. In a report, titled, “Green Finance in India: Progress and Challenges” compiled by the Reserve Bank of India in 2021, till February 2020, India accounted for an outstanding debt of $16.3 billion in green bonds[4]. This has made India the second largest emerging green bonds market in the world after China.

Indian banks and other financial institutions (like NBFCs and Indian Railway Finance Corporation which issued bonds which raised $500 million[5]) have rolled out their instruments for public sector organisations and firms to catalyse them for green initiatives. For instance, in 2018, State Bank of India (SBI) raised $650 million by the issuance of the first tranche of green bonds[6]. These are sovereign debt and reflect the Government of India liabilities. These instruments are fully backed by the government.

How are green bonds issued in India?

For the purpose of listing and trading in sovereign green bonds, the government designated India International Exchange (India INX) situated in Gandhinagar, Gujarat as the forum[7]. This allows global investors and high-networth individuals to purchase green bonds in multiple currencies. For instance, the green bonds that were issued by SBI in 2018 were listed on India INX, Luxembourg Stock Exchange, and Singapore Stock Exchange. Table 1 lists recent issuances of green bonds by Indian firms in 2021 and 2022. Apart from these, Rural Electrification Corporation listed their bonds in 2017 and Yes Bank in 2015.

Table. 1. A few examples of recent green bonds issued by Indian firms

| Issuer | Amount (in $ million) | Tenure | Issued in |

| ReNew Energy Global [8] | 400 | <5 years | January 2022 |

| State Bank of India | 650 | 5 years | November 2021 |

| Adani Green Energy Limited[9] | 750 | 3 years | September 2021 |

| ACME Solar[10] | 334 | 5 years | July 2021 |

| Adani Electricity Mumbai Limited[11] | 300 | 10+ years | July 2021 |

Most green energy companies or those into new and renewable energy resources have seriously taken these bonds as a sustainable route to raise debt funds for expansion of their greenfield projects.

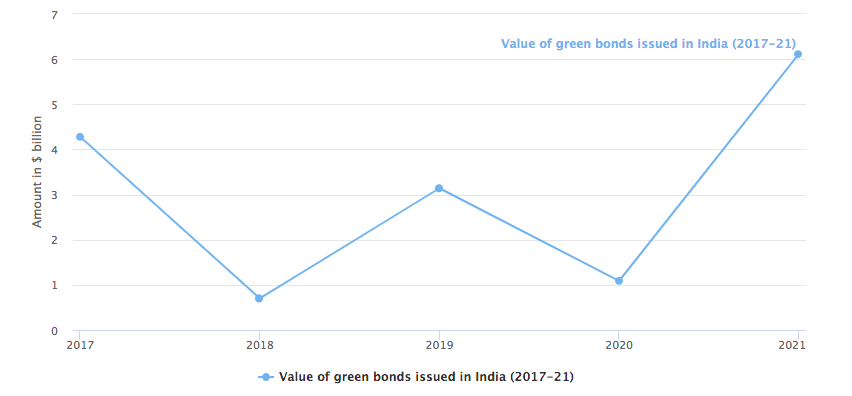

Fig. 1. Volume of Sovereign Green Bonds issued in India during 2017-21[12]. Source: Statista; Climate Bonds Initiative; CIHS Analytics.

Most of these have been issued for a period of over five years, with an exception of Adani Electricity Mumbai Limited which issued them for a period over 10 years. At present, green bonds are not open for all investors but for those individuals and investors which have focused projects for the green economy.

Global status

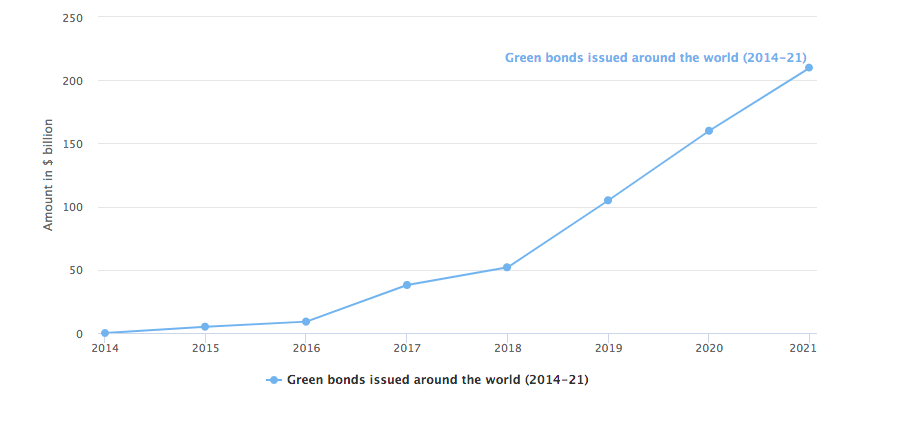

Ever since nations pledged the Sustainable Development Goals (SDGs), there has been an increase in issuance of green bonds all over the world. Fig. 2 shows the cumulative amount of green bonds issued across the world during 2014 to 2021.

Fig. 2. Amount of green bonds issued globally. Source: Climate Bonds Initiative; CIHS Analytics.

Key insights from global issuance of green bonds during 2021-22[13]:

- Société du Grand Paris, the national railways of France was the single largest issuer of green bonds in 2021, with over $7.6 billion issued for green projects.

- Chile issued SGBs worth Euro 400 million and $750 million (total ~$1.26 billion) with a focus on low carbon infrastructure and transportation sectors.

- Queensland Treasury Corporation (Australia) issued SGBs worth $2.21 billion to finance low carbon buildings and infrastructure across the state.

- State-owned China Development Bank issued SGBs worth $6.17 billion to promote ecological development along the Yellow River Basin.

- Industrial and Commercial Bank of China (ICBC), issued SGBs worth $3.23 billion to finance projects in the sectors of low carbon transport, marine energy, solar energy, and other sources of renewable energy.

Table. 2. Top 10 issuers of SGBs across the world (2021-22)

| Institution | No. of debt instruments | Bond value (in $billion) |

| Société du Grand Paris | 4 | 7.62 |

| China Development Bank | 3 | 6.17 |

| India (cumulative) | NA | 6.11 |

| ICBC Limited (London branch) | 1 | 3.23 |

| Queensland Treasury Corporation | 1 | 2.21 |

| DNB Boligkreditt AS | 1 | 1.67 |

| Geysers Geothermal | 1 | 1.5 |

| Republic of Chile | 1 | 1.24 |

| Westpac | 1 | 1.21 |

| Japan Rail Construction Transportation and Technology | 5 | 1.21 |

| Ferroive dello Stalo | 1 | 1.18 |

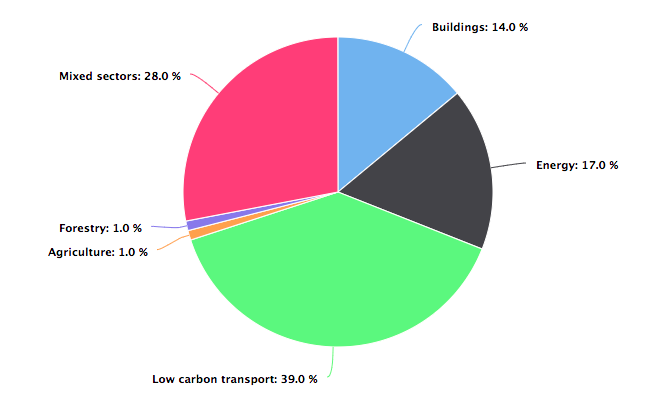

Certified sectors for investment across the globe

SGBs are certified by institutions across the world and are classified into five broad categories. These sectors have been certified by nations internationally. These have been shown in Fig. 3.

Fig. 3. Certified sectors for issuance of SGBs. Source: Climate Bonds Initiative; CIHS Analytics.

A gist of India’s SGBs Framework

At the core of India’s framework for sovereign green bonds[14] is the need to create a mechanism which will ensure that only green projects are financed. For this, the framework has the following provisions:

- The framework adheres to the Green Bond Principles 2021 issued by the International Capital Market Association (ICMA).

- Recommendations of these Principles mandate that the issuing authority/agency of these bonds must ensure that the process of investing is clearly explained to investors and banks. This will help the stakeholders understand the purpose of green bonds.

- There will be an oversight committee for the issuance of SGBs. The Green Finance Working Committee (under the Chairman of the Economic Advisory Council) will have members of the NITI Aayog, Ministry of Environment, Forest, and Climate Change, and from the Ministry of Finance. The Committee will be responsible for processing applications in a fair manner and handling other matters related to these green projects.

- The proceeds of these bonds will be directed to the Consolidated Fund of India and the funds will be made available by the Reserve Bank of India for green projects.

Concluding observations India’s newly launched framework for sovereign green bonds can aid in achieving India’s climate goals and its pledge towards the SDGs. The net value of these bonds has increased multifold in the last few years which is indicative of India’s seriousness in achieving net-zero carbon emissions by 2070. The framework will work in tandem with norms laid down by SEBI which requires companies to publish reports on their environment and climate related activities. With the framework in place, companies and high-net-worth individuals now have a plethora of options to choose from compared to earlier years where green bonds were largely limited to the private sector. This will also help India emerge as a key market in the green debt instruments.

[1] Budget2022 is a step towards innovative & Sustainable Development in New India to strengthen our energy transition journey and fight climate change: Power minister (no date) Press Information Bureau. Available at: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1794473 (Accessed: November 16, 2022).

[2] ESG investing and analysis (no date) CFA Institute. Available at: https://www.cfainstitute.org/en/research/esg-investing (Accessed: November 16, 2022).

[3] Green Finance in India: Progress and Challenges (no date) Reserve Bank of India – RBI Bulletin. Available at: https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=20022 (Accessed: November 16, 2022).

[4] Green Finance in India: Progress and challenges* – reserve bank of India (no date). Available at: https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/04AR_2101202185D9B6905ADD465CB7DD280B88266F77.PDF (Accessed: November 16, 2022).

[5] Indian Railway Finance Corporation (2019) Climate Bonds Initiative. Available at: https://www.climatebonds.net/certification/indian-railway-finance-corporation (Accessed: November 16, 2022).

[6] Press release – State Bank of India (no date). Available at: https://sbi.co.in/documents/39129/52199/SBI+press+release_21092018.pdf (Accessed: November 16, 2022).

[7] https://www.indiainx.com/

[8] https://renewpower.in/wp-content/uploads/2022/01/ReNew_raises_400_million_by_issuing_Green_Bonds.pdf

[9]https://www.adanigreenenergy.com/-/media/Project/GreenEnergy/Corporate-Announcement/Others/02092021-Press-Release-Adani-Green-Energy-continues-to-Ramp-up-focus-on-ESG-Raises-USD-750-Mn-to-ful.pdf?la=en

[10] Acme Solar Holdings successfully raises $334 million via offshore Green Bonds (no date) ACME Group. Available at: https://www.acme.in/media-release/18/acme-solar-holdings-successfully-raises-dollar-334-million-via-offshore-green-bonds (Accessed: November 16, 2022).

[11] Adani Electricity Mumbai raises $300 million through sustainability bonds (2021) Business Today. Available at: https://www.businesstoday.in/latest/corporate/story/adani-electricity-mumbai-raises-300-million-through-sustainability-bonds-302194-2021-07-23 (Accessed: November 16, 2022).

[12] Published by Statista Research Department and 30, A. (2022) India: Green Bond issuance volume 2021, Statista. Available at: https://www.statista.com/statistics/1325340/india-green-bond-issuance-volume/ (Accessed: November 16, 2022).

[13] Certified Green issuance reaches $200bn – expansion of climate bonds standard in 2022 – basic chemicals, cement, steel in pipeline (2022) Climate Bonds Initiative. Available at: https://www.climatebonds.net/2022/01/certified-green-issuance-reaches-200bn-expansion-climate-bonds-standard-2022 (Accessed: November 16, 2022).

[14] dea.gov.in (no date). Available at: https://dea.gov.in/sites/default/files/Framework%20for%20Sovereign%20Green%20Bonds.pdf (Accessed: November 16, 2022).